As many of you know, I run a real estate investment association (REIA for short) here locally. The purpose of our group is to provide the tools and resources to help people become financially free and provide support and encouragement to them during their journey.

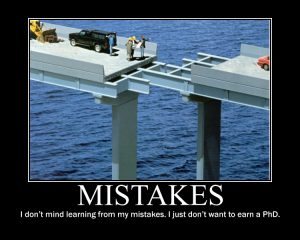

At a recent meeting I discussed what I found to be the most common deadly mistakes I see new investors make – over and over again, and often with disastrous consequences.

Because you’re not local (I’m making that assumption, otherwise I’m sure you’d attend the REIA  I’m going to share them with you here.

I’m going to share them with you here.

Deadly Mistake #1: Lack of Training

There’s two ways to learn anything in life – the easy way and the hard way. The easy way is to learn from others and their mistakes. The hard way is to do it yourself and try to reinvent the wheel. People that don’t see or appreciate the value in education or are too stubborn or prideful to take the qualified advice of others have pain coming to them.

I’m not saying you have to go out and get a coach (although personally I think that’s the fastest and easiest way to success), but at least check out free or low cost resources at a minimum.

Deadly Mistake #2: Pursuing Too Many Strategies

“He who chases two rabbits catches none” I read that on a fortune cookie once and it’s 100% true. And yes, I’m speaking from experience. This has been one of my biggest obstacles personally since I seem to suffer from “Shiny Object Syndrome”.

Bird dogging…wholesaling…rehabbing…lease-options…notes…commercial…wholesaling lease-options…contract for deed…Sub2…rentals…short sales…mobile homes…need I go on????

There are 1000 different ways to invest in real estate but you can’t do them all successfully. Choose 1 or maybe 2 at the most (if they’re complementary – like wholesaling and rehabbing) and THAT’S IT! Otherwise you’re setting yourself up for failure.

Choose on 3 criteria – (1.) How much you enjoy it, (2.) if it matches your resources and skill set, and (3.) If it meets your life vision (profit margins, time involved, etc.)

Deadly Mistake #3: Letting Emotions Interfere With Your Investing

This is a big one and can happen on the purchase or resale side of the transaction and can affect both new and seasoned investors.

How many new investors have been (or still are) terrified to do that very first deal? How many investors have waited years to pull the trigger? Why – because they’re paralyzed by fear of the unknown and of making a mistake.

Or you have investors that force the numbers on the purchase because the “need” a deal. They haven’t had a deal in a while and are freaking out. They end up buying something marginal and either get burned or tie up precious resources that could have been used elsewhere when a better deal comes along.

Here’s another example on the resale side of things – you’re done your rehab and it’s been on the market for two weeks and you start losing sleep. Afraid it won’t sell, and decide to slash the price to move it and make no money.

OR how about this – you list it significantly over and above reasonable comps because you want more money for it even though it’s been sitting on the market for 120 days.

In all these cases, it’s EMOTION that is in control, not logic and reason.

How do you avoid falling into this trap and keep a level head when investing?

- Remember anything new is scary (remember that first hill on your bicycle?)

- Calculate the risks on paper ahead of time – do a worst, best, and likely case scenario.

- Have someone experienced you can trust to discuss the deal with. A coach, fellow investor, or educated friend.

There were a bunch of “runner up” mistakes like…

- Treating investing like a hobby

- Not keeping your deal funnel full

- Trying to do it all yourself

- Being an opportunist rather than a strategist

But we don’t have time to discuss all those in this post.

In the meantime, avoiding these 3 should have a significant positive impact on your business and bottom line.

I’d love to hear your comments below as to what mistakes you’ve made or seen others make and how you fixed or overcame it.

Tags: investor mistakes / Real Estate Investing / REIA